How to Use Your Flexible Savings Account to Save Money and Avoid Wasting Benefits

Source: https://lifehacker.com/

It’s that time of year again: Open enrollment season for your employer benefits, which, if you’re lucky, includes the Flexible Savings Account (FSA). If you’ve always told yourself around this time “I should really take advantage of my FSA” but never do, now’s the time to correct that grave financial mistake. Having an FSA is like getting a 30% discount on health care and dependent care costs (free money, people!). There are some big “gotchas” but don’t worry, we’ll help you avoid them.

Why You Should Use/Care About FSAs

Two words: big savings. Depending on your expenses and your tax bracket, you can save hundreds to thousands of dollars on stuff like dental work and prescriptions, as well as on something we normally never get a break on (and pay up the wazoo for): childcare and care for other dependents.

How much can you save?

, the official FSA site for US Federal employees, says that an FSA can save you from 20% to more than 40% you would normally pay out-of-pocket for these costs, with the average person saving about 30% each year. That’s because the FSA reduces how much you have to pay in taxes each year (so, more money for you and less for Uncle Sam).

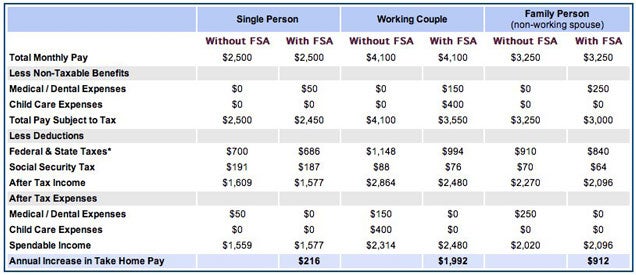

Here’s an example from , a medical insurer, of how using an FSA can result in more money in your pocket:

Obviously, the higher your health care and childcare expenses and the higher your tax bracket, the higher your potential savings. But even if you’re a super-healthy single person with just $50 in medical and dental expenses, you’ll come out $216 ahead. Not too shabby.

How do they work?

Basically, an FSA lets you set aside money for health care expenses and dependent care costs you think you’ll have next year. The money comes out of your paycheck before taxes are deducted, which leads to all those big savings.

Every year, you have just a few weeks to sign up for the Health Care FSA and/or the Dependent Care FSA through your employer’s benefits program. The exact start and end date of the enrollment period varies (my husband got a notice that his starts in four days, but Federal employees’ open season starts Nov. 14 this year). Look out for a notice in the mail or a nice note from your HR department.

Not sure if your company offers the FSA? Chances are if your company has at least 50 employees it does, because companies get tax savings with the FSA too.

You have to decide during the couple of weeks of enrollment how much you think you’ll need for the entire next year’s health and dependent care costs—so get ready to put on your estimating (or psychic prediction) hat. This is the tricky part, but we’ve got some tips below for figuring out the right FSA budget.

The most you can put into the FSA account is up to your employer and the state you live in, but typically you can put up to $5,000 in the Health Care FSA and up to $5,000 in the Dependent Care one, with many plans requiring you to set aside at least $250 for next year.

After you enroll in the fall, the money you set aside will be spread out over the next year starting in January and automatically deducted from each paycheck. You have 14.5 months, thanks to a 2.5 month grace period, to use the money in your FSA accounts (in other words, you have until March 15th of the following year, or 2013 for this season).

One neat feature is even if the FSA contributions to date aren’t enough to cover an expense, you can still get reimbursed for it, as long as your election amount for the year is enough to cover the expense. So, for example, if in February you have a large $3,000 medical bill but only $50 deducted so far, you can still submit a claim for the full bill in February.

What’s the catch?

FSAs come with a big gotcha: Any money you don’t use up for the year is forfeited, which makes enrolling in an FSA a bit tricky and a reason lots of people shy away from it. You want to set aside enough to cover all or most of your eligible expenses so you get the most tax savings, but also don’t want to set aside too much and end up losing what you set aside. (By the way, if you don’t like this “use it or lose it” rule, the FSA’s new less-flexible OTC restrictions, or anything else, you can .)

Another challenge is deciding whether to opt for the FSA or take a tax credit for your expenses. The IRS offers a childcare tax credit of 25% to 35% back on up to $3,000 in childcare expenses (up to $6,000 for two or more kids). In some cases you can claim both the credit and have the Dependent Care FSA—but you’re not supposed to claim the same expenses for both. To find out what to do, you’ll need to run some numbers.

What Can You Save on with an FSA?

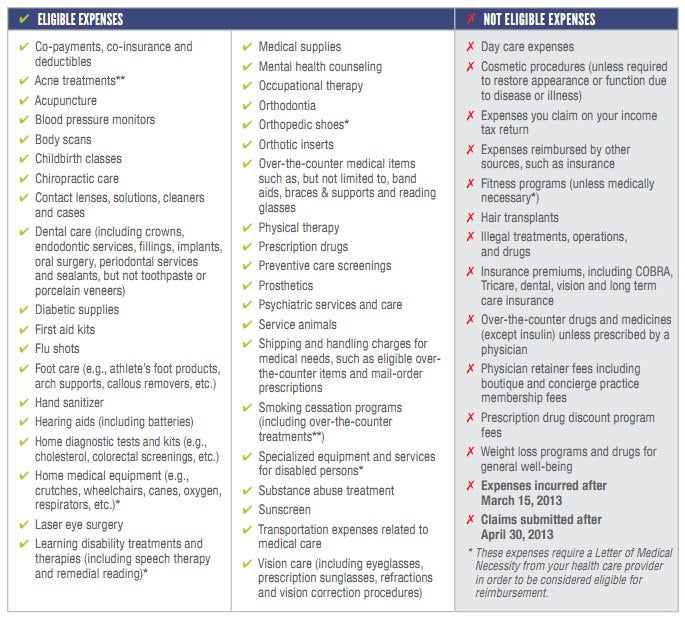

Okay, so what qualifies as eligible health care and dependent care expenses? An awful lot, but, as is typical with tax breaks, many rules and exceptions, and new changes each year, add to the confusion.

Dependent Care FSA: The most important rule for being eligible for the Dependent Care FSA is that you and your spouse are gainfully employed; the FSA is intended to help people with work-related dependent care costs. The dependent can be any child under age 13 or any dependent you claim on your tax return who lives with you and is not capable of self-care (including parents and siblings). Day care centers and summer camps are examples of eligible expenses; babysitting at night (when you’re not working) and kindergarten are not.

Health Care FSA: Health care expense eligibility is more complex, and this year over-the-counter drugs (except insulin) are no longer eligible unless you have a prescription for it, making OTC drug-buying with the FSA program more of a hassle.

Common expenses that you can pay for with an Health Care FSA include: medical and dental co-pays, prescription medicine, eyeglasses and vision exams, orthodontia. , like bandages and condoms, are also eligible.

You’ll want to consult your company’s FSA brochure to check for eligible expenses, but here’s a handy list from FSAFEDs:

SHPS, a health benefits administrator, has an you can refer if your FSA brochure hasn’t arrived yet.

As you can see, you can get a tax break on some surprising health expenses, including acupuncture, sunscreen, hand sanitizer, and first aid kits.

How to Figure Out How Much to Put into Your FSA

Use an FSA calculator: The easiest way to figure out how much to put aside is to use a calculator, such as . The tool can help you figure this all out: whether the Health Care FSA is worth it, what expenses you expect to have, and how much you can save. It asks how many doctor visits you’ll have, how many monthly prescriptions to fill, and so on.

Look at previous health expenses: Many people look back on their medical expenses they had this year and use that as the amounts during their calculations. While that’s a good start, you’ll need to decide which expenses really will apply next year and any new expenses you might have; maybe you won’t get new glasses, for example, or you want to get LASIK next year.

Go see your doctor: Here’s what I suggest: go see your dentist and doctors now, before you make your enrollment. With a full workup now, your doctors can help you plan for any elective health care that you can budget for. If you need a new crown on a tooth or something else very costly, now’s the time to find out.

Deciding on the Dependent Care FSA or the childcare credit: Deciding how much to put into the Dependent Care FSA is pretty easy, since those costs are pretty predictable. However, if you’re not sure whether to take the childcare tax credit or the Dependent Care FSA or a mix of both, consider these tips from : the more you earn, the more the FSA is the better choice—especially if you’re above the 25 percent federal tax bracket. If you have dependent care expenses of at least $3,000 and are in the 15 percent tax bracket, you may be best off with the FSA as well.

For your estimate make sure you factor in after-school care costs and summer camp, if applicable.

Finally, for both the Health Care FSA and the Dependent Care one, err on the side of caution to make sure you don’t over-budget. I usually only include expenses that I know for sure I will actually accrue and round down my estimate.

Now it’s your turn. Got any of your own tips for making the most of your FSA? Share them with us in the comments.